Nintendo Financial Results – Six Months Ended September 30th, 2018 (April 1st – September 30th)

Today, the Nintendo financial results for the Six Months Ended September 30th, 2018 were revealed, and as expected, they’re still pretty good. The company is riding on the success of the Nintendo Switch, though the increase in sales did slow down a fair bit after the Nintendo Switch launch and its explosive sales last year (due to a bigger focus than usual on Q3 this year). Still, the company is still in the black, and it doesn’t look like it’s going to change any time soon.

Nintendo Financial Results – Raw Data

Let’s start with some raw data:

- Net Sales (FY): 388 905 million Yen (3.043 billion € / 3.466 billion $ / 2.703 billion £), an increase of 4% over the same period last year (374 041 million Yen, an increase of 173.4% over the same period during the previous Fiscal Year);

- Net Sales (Q2): 220 748 million Yen (1.727 billion € / 1.967 billion $ / 1.534 billion £)

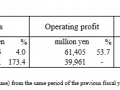

- Operating profit (FY): 61 405 million Yen (480 million € / 547 million $ / 426 million £), an increase of 53.7% over the same period last year (39 961 million Yen);

- Operating profit (Q2): 30 870 million Yen (235 million € / 274 million $ / 209 million £);

- Ordinary profit (FY): 91 931 million Yen (719 million € / 819 million $ / 639 million £), an increase of 32.1% over the same period last year (69 591 million Yen);

- Ordinary profit (Q2): 48 065 million Yen (376 million € / 428 million $ / 334 million £);

- Profit attributable to owners of parent (FY): 54 576 million Yen (427 million € / 486 million $ / 379 million £), an increase of 25.4% over the same period last year (51 503 million Yen, an increase of 34.5% over the same period during the previous Fiscal Year);

- Profit attributable to owners of parent (Q2): 33 976 million Yen (265 million € / 302 million $ / 236 million £);

- Digital sales (FY): 39.1 billion Yen / 306 million € / 348 million $ / 271 million £ (as opposed to 22.8 billion Yen / 178 million € / 202 million $ / 158 million £ during the same period last year);

- Digital sales (Q2): 20.6 billion Yen / 161 million € / 183 million $ / 143 million £

The chart below shows the proportion of Software / Hardware / Other (accesories, amiibo) in sales, but also the geographical breakdown of sales. Sales are up everywhere but in Japan, due to a weaker Summer season (last year had Splatoon 2). Most of sales were made outside Japan (a positive sign, as Europe + North America is a much bigger market than Japan onle). To be precise, sales topped 3 billion Yen outside Japan: that’s roughly 77.8% of total sales.

The Nintendo Switch once again account for most of sales this half (~78% of total sales) with the smart devices games making slightly more money (though it’s nowhere near what the dedicated game platforms bring: even the aging Nintendo 3DS alone still made Nintendo more money, though the gap is closing little by little). This particular area account for only 4.8% of total sales, with about 18.766 billion Yen in Q1 + 2.

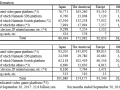

Here’s data for Q2 specifically (all data is in million of Yen):

- Dedicated video game platforms (Hardware, Software, Accessories) – Japan: 42 182 / North America: 94 136 / Europe: 57 721 / Other: 16 583 / Total: 210 613

- Nintendo 3DS – Japan: 4 614 / North America: 7 017 / Europe: 4 092 / Other: 694 / Total: 16 416

- Nintendo Switch – Japan: 33 106 / North America: 77 345 / Europe: 50 151 / Other: 15 506 / Total: 176 109

- Other (inc. amiibo, Virtual Console) – Japan: 4 461 / North America: 9 776 / Europe: 3 467 / Other: 382 / Total: 18 088

- Smart devices, IP – Japan: 4 770 / North America: 3 723 / Europe: 706 / Other: 469 / Total: 9 669

- Playing cards, others – Japan: 250 / North America: 311 / Europe: 16 / Total: 467

- Total – Japan: 47 101 / North America: 98 172 / Europe: 58 422 / Other: 17 052 / Total: 220 748

And here’s some more data:

- Hardware sales = 57.8% of total sales during Q1+2 2018-19, and ;

- First-party games = 76.8% of total Software sales during Q1+2 2018-19;

- Digital sales = 25.1% of total Software sale during Q1+2 2018-19.

Nintendo Financial Results – Hardware / Software Sales

- Nintendo 3DS: 1 000 000 units for Fiscal Year / 640 000 units for Q2 2018-19 / 73.53 million units since launch;

- Nintendo 3DS (Software): 6.27 million units for Fiscal Year (22 new games launched in all regions*) / 3.32 million units during Q2 2018-19 / 371 116 million units since launch (1 700 games launched*)

- Nintendo Switch: 5.07 million units for Fiscal Year / 3.19 million units for Q2 2018-19 / 22.86 million units since launch

- Nintendo Switch (Sofware): 42.13 million units for Fiscal Year (330 games launched in all regions*) / 24.13 million units units for Q2 2018-19 / 111 100 million units since launch (766 games launched*)

* games released in more than one region are counted several times (example: 1 game in 3 regions: counted 3 times). Only include games released at retail.

Here’s some details about Nintendo 3DS sales:

- New Nintendo 3DS XL – 12 130 000 (+ 120 000 units for Fiscal Year, 60 000 units for Q2 2018-19)

- Nintendo 2DS – 9 680 000 (+ 290 000 units for Fiscal Year, +180 000 units for Q2 2018-19)

- New Nintendo 2DS XL — 3.32 million units (+410 000 units for Fiscal Year, 210 000 units for Q1 2018-19)

Nintendo Financial Results – Forecast comparison

Here’s Nintendo’s forecast for the current Fiscal Year:

- Net sales: 1 200 billion Yen (+ 145 billion Yen compared to FY 2017-18)

- Net sales (actual result as of September 30th 2018): 388 905 million Yen (811.095 billion Yen left)

- Operating profit: 225 billion Yen (+ 48 billion Yen compared to FY 2017-18)

- Operating profit (actual result as of September 30th 2018): 51 405 million Yen (173.595 billion Yen left)

- Ordinary profit: 230 billion Yen (+ 31 billion Yen compared to FY 2017-18)

- Ordinary profit (actual result as of September 30th 2018): 91 931 million Yen (138 billion Yen left)

- Net profit attributable to owners of parent: 165 billion Yen (+26 billion Yen compared to FY 2017-18)

- Net profit attributable to owners of parent (actual result as of June 30th 2018): 64 576 million Yen (100.424 billion Yen left)

As for the Nintendo 3DS, and the Nintendo Switch specifically:

- Nintendo 3DS: 4 million units (- 2.4 million units compared to FY 2017-18)

- Nintendo 3DS (actual result as of September 30th 2018): 1 000 000 units (3 000 000 units left)

- Nintendo 3DS Software: 16 million units (-19.64 million units compared to FY 2017-18)

- Nintendo 3DS Software (actual result as of September 30th 2018): 6.27 million units (9.73 million units left)

- Nintendo Switch: 20 million units (+5.05 million units compared to FY 2017-18)

- Nintendo Switch (actual result as of September 30th 2018): 5.07 million units (14.93 million units left)

- Nintendo Switch Software: 100 million units (+37.49 million units compared to FY 2017-18)

- Nintendo Switch Software (actual result as of September 30th 2018): 42.13 million units (57.87 million units left)

Nintendo Financial Results – Nintendo comments

Nintendo explain that during the 6 months ended September 30th, Nintendo Switch Hardware sales grew slightly Year on Year: +3.7%.

Software-wise, Donkey Kong: Tropical Freeze was one of the popular releases with 1.67 million units sold since launch, while Mario Tennis Aces sold 2.16 million units since June. Previously released first-party games, along with third-party games, also enjoyed strong sales. According to the company, there’s now 9 million-sellers on Nintendo Switch, including titles from 3rd-party publishers. Year on Year, Software sales increased by 91.3%; there was not as many big hits as last year, but the richer library certainly seems to have helped a lot!

On the Nintendo 3DS front, the old age of the dual-screen handheld is clearly showing (already its 8th year on the market). Hardware sales are down by 65.1% Year on Year, and Software sales are down by 54.6% Year on Year. Captain Toad: Treasure Tracker and WarioWare Gold are the two titles mentioned in Nintendo’s report, but no sales data are provided.

As for the Nintendo Entertainment System: NES Classic Edition and the Super Nintendo Entertainment System: Super NES Classic Edition, they’re still enjoying strong and steady sales with 3.69 million units sold (that’s counting the 1.26 million units sold for the Nintendo Entertainment System: NES Classic Edition in Q1).

Thanks to strong sales of downloadable versions of retail games and DLC, digital sales are up by 71.7% Year on Year (39.1 billion Yen).

On the smart device front, Nintendo only mentions a “good start” for Dragalia Lost, but does not provide any concrete data. Meanwhile, Super Mario Run, Animal Crossing: Pocket Camp and Fire Emblem Heroes are “maintaining steady popularity”. As whole, the business grew slightly, with +4.7% Year on Year.

Nintendo Financial Results – Forecast

Nintendo decided not to make any changes to its financial forecast for the current Fiscal Year.

On Nintendo Switch, Nintendo mentions the following key titles:

- Super Mario Party (released in October)

- Pokémon: Let’s Go, Pikachu! / Let’s Go, Eevee! (out on November 16th worldwide), alongside the Poké Ball Plus accessory

- Super Smash Bros. Ultimate (out on December 7th worldwide), alongside amiibo of new characters

Their strategy for the platform remains the same: accelerate the momentum by releasing compelling new games, alongside those already available.

On Nintendo 3DS, same old strategy: leverage the rich library and Hardware install base to further increase sales of evergreen titles.

Finally, on the smart device front, there’s two elements to Nintendo’s strategy:

- release Mario Kart Tour

- keep releasing new content for games already available so that players keep enjoying them for a long time